1. What are you trying to buy programmatically? Content or behavior?

The easiest and most cost-effective way for a vendor to supply programmatic inventory is through content buys. Vendors avoid the cost of data by grouping websites together in a network that should be relevant to the advertiser. Content buying is targeting consumers who should be… by targeting website A, the consumers engaging with the domain should be interested in my advertiser.

Behavioral targeting is a different process all together. The data is expensive and difficult. Most programmatic vendors don’t understand nor realize the strength of data, because they don’t own their own data. Premium data targets come with a mix of first and third party data segments with frequency and recency qualifiers. Frequency indicates how often the behavior was observed and recency indicates when the behavior has occurred. For example, the behavioral audience of auto buyer enthusiasts created by Advance Digital caries a frequency of three and a recency of seven (three observed behaviors within a seven day period).

If a vendor does not have access to first party data controlling recency or frequency they are forced to use primarily 3rd party data. With solely 3rd party, it is impossible to know when the activity occurred, thus creating the possibility of advertising to consumers who have already purchased the product and/or are no longer in the market.

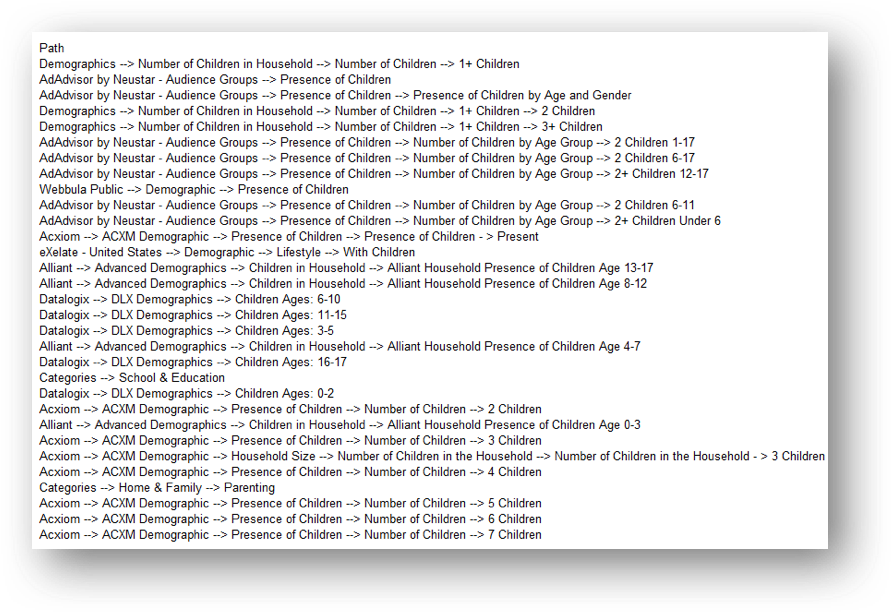

2. Do you know how your behavioral audience is built? Ask your vendor for an audience or contributing behavior report.

Fig. A – Advance Digital Contributing Behavior Report – First and Third Party Audience Blend

3. What percentage of the digital buy will be allocated to creative remessaging?

4. Is your buy within a specific network(s) or running though and Ad Exchange?

5. Is your programmatic vendor bidding above the fold or is it a remnant buy?

Programmatic inventory goes to the highest bidder. If you are running at a low CPM, the Viewability and the quality of your supply will take a drastic hit. Therefore, you should use a dynamic CPM strategy by running a few campaign lines to the same target. This way, you can assess if your Viewability and quality responses increase with stronger CPMs.

6. Can your programmatic vendor supply viewability reporting and optimization?

There are two critical factors when talking campaign viewability. The first deals with how the inventory is being served / purchased. On the ad server level, viewability can be affected by bid caps and positing request. Ask your vendor if they are buying inventory with eCPM’s large enough to land above the fold. You can also request above the fold positioning which may happen based on bid cap, but it is always a good idea request it.

Not all programmatic inventories are created equal, so being able to optimize to viewability can be tricky. In fact, viewability optimization is kind of a rare occurrence. Usually viewability optimization takes human interaction and translation. The task is generally not automated. Request a viewability report by domain and creative. Once achieved, remove poorly performing domains and creative. Viewability should increase as a result.

If you’re looking for 100% in view advertising, seek out ad Cost-Per-View (CPV) display program, high impact publisher inventory, or native advertising. Unfortunately, all carry a higher price tag.

7. Does the provider have an anti-spam strategy? Does the provider self –identify fraudulent click activity? Can you request domain reports as part of your standard reporting stack?

Some exchanges (AppNexus for example) offer domain lists that have been certified/ vetted against click fraud. These domains can be requested. This process should not increase the CPM.

8. Can you use marketing attribution techniques within your campaign?

9. Does the ad creative carry Data Management Platform (DMP) click and view behavioral reporting? Can you collect online consumers who respond to your messaging into behavioral audiences for use at a later time?

DMP pixels also allow you to further develop your attribution strategies. Consumers who respond to your display ads can be compiled into a “clicker” audience. Your clickers can then be targeted directly or mixed with other 3rd party data segments to create invaluable custom audiences specifically for your clients.

10. Can the campaign be integrated into your website analytics? Do you have an attribution strategy?

Warning: if you do not use Campaign URL’s you will not be able to directly see website traffic generated from your programmatic campaign. Most publisher sites do not disclose their identity online and thus will show on your analytics ad a referral vs. the website domain.